Bitcoin Transaction Wars: Why we need to decentralize mining with home mining.

There is a new Bitcoin War on the horizon: the Bitcoin Transaction War, which transactions are going to be included by miners in blocks.

There is a new Bitcoin War on the horizon: the Bitcoin Transaction War, similar to the Blocksize War but this time about which transactions are going to be included by miners in blocks. While this might seem strange at first glance, let me explain why I think this will happen and what we can do about it.

Miners fulfill a very important role in the Bitcoin network: They create blocks that include transactions created by users using the Bitcoin network. A block is generated roughly every 10 minutes and can include around 2,500 transactions. One often forgotten aspect is that the miner and only the miner chooses which transactions to include into a block. The game theory of Bitcoin says that it makes sense for a miner to include transactions with the highest fees in their block in order to receive the biggest reward for mining of the block.

There is, however, nothing that prevents a miner from not including a specific transaction that the miner might not like, even if it’s one with very high fees. Companies like Chainalysis or TRM Labs already today rank every address in the Bitcoin network with a risk score determining if the address, or more specifically the Unspent Transaction Output (UTXO) might have been used for illegal activities. The company zkSNACKs, which runs one of the biggest coinjoin coordinators, already announced that they will blocklist specific addresses/UTXOs from using their conjoin coordinator. While a zkSNACKs blocklisted address could still do a normal on-chain transaction, it's not far fetched that some miners will start to blocklist addresses which then could possibly block an address from transacting altogether or make it very hard. In fact, there was a mining pool started in March 2021 that censored specific addresses from being added to blocks. Luckily, they stopped this practice just a couple of weeks later in June 2021, but the precedent is there.

Now, of course, this doesn’t mean that an address could be blocked completely from transacting on the Bitcoin network. If there are many censoring miners, the inclusion of a censored address could take quite a long time to be included, possibly making Bitcoin for these blocked addresses almost unusable. Additionally if non-censoring miners are including all addresses, censoring miners could orphan entire blocks that contain a blacklisted address. If enough censoring miners work together to reject non-compliant blocks then these larger, censoring miners will preferentially mine on each other's chains disregarding blocks they do not agree with.

As some mining companies are adding massive amounts of hash power, this could become a problem:

Sanctions & Bitcoin Miners

We need to understand that today big parts of Bitcoin mining are unregulated, while every other part of global trading needs to comply with sanctions. For example the United States has very strict sanctions against Iran which every company in the country has to comply with. Companies not complying will face high penalties or even prison sentences.

Today, the US accounts for around 35% of all Bitcoin hash rate (and rapidly growing). It would be possible for the government to require US based mining companies to comply with specific sanctions and block transactions from a specific country. US crypto exchanges already have to comply with sanctions against Russia. These sanctions prevent Russian-originated Bitcoin addresses from using these exchanges. Just recently the United States sanctioned Bitriver, a Russian crypto miner, in an attempt to prevent Russia from mining their excess energy, which they now have because of other sanctions.

It’s just a matter of time until governments realize how mining really works, and that they technically have leverage via the Bitcoin miners and will require miners to comply with sanctions.

Long story short: While it’s awesome to see that Bitcoin mining is massively growing, helping to stabilize the electrical grid and encouraging building of more renewable energy, we should be careful to not end up with a centralized mining infrastructure of a few big companies. Governments will force the miners to comply like the exchanges are complying with sanctions. The fewer mining entities exist, the easier it is for governments to control high percentages of mining and that could cause a great amount of damage and pain to the Bitcoin network. Just imagine a future where NATO decides that all its member states need to force the miners in their countries to sanction specific Bitcoin addresses.

Not your miner, not your block

Bitcoin wouldn’t be Bitcoin if it wouldn’t have a solution to this problem.

Like we already use:

- “Not your keys, not your coins” to explain to people to store their Bitcoin by themselves not at an exchange

- “Not your node, not your validation” to encourage people to run their own Bitcoin node to ensure the Bitcoin network validates transactions correctly.

So we also should start saying:

“Not your miner, not your block”

to explain to people that if they want to ensure a fair inclusion of transactions in blocks, they should mine themselves, at home.

Only with home mining can we ensure that the Bitcoin network is fair and works for the people.

Side note 1: I’m focusing specifically on miners and not pools. Bitcoin mining pools are a form of centralization which incentives miners to join pools as they create a more stable income for miners. Due to this effect it’s difficult to truly decentralize hashrate. Though If a pool would start to misbehave and start sanctioning transactions, it would be easy for miners to point their hashrate to another pool, therefore creating a game theory where it doesn’t make sense for governments to force pools to comply. Also with Stratum V1 (the protocol miners use to connect to pools) it’s the pool that chooses the transactions included in a block. There is a new version 2 of Stratum that includes “Job Selection” which allows a miner instead of the pool to define which transactions they want to include. There is growing support for Stratum V2 within pools.

Side note 2: There are mining companies (like Compass Mining) that allow you to mine in someone else's data center, unfortunately there have been numerous delays in getting miners up and running, plus the US sanctions against Russia forced Compass Mining to shut down their Russian data center and they are liquidating all miners. Therefore I do not suggest using such a service, as it’s like with anything else in Bitcoin: If it’s not your location and electricity it’s not your hash.

Therefore I believe that we should all start to mine at home, luckily there are already companies like FutureBit and Coinmine that provide plug and play home miners which do not require any knowledge of how to build a mining rig.

Plus we could actually save money while doing it:

Home mining take one:

a no-brainer electrical heat replacement

Bitcoin miners convert the energy they consume 100% into heat. The same is true for electric water heaters, electric space heaters, electric water kettles and anything else that uses electric resistance heating. Therefore it would make sense to replace these heaters with a Bitcoin miner. The miner will use the same amount of energy, produce the same amount of heat, but also generate Bitcoin at the same time. Such a heater would therefore save you money as you would have spent the energy anyway.

We could go even so far and describe an electric resistance heater as a dumb miner.

Of course a Bitcoin miner has a higher upfront cost than a space heater, the higher cost will be covered over time with the value of the mined bitcoin, but not everybody has the capability to buy a $1000+ space heater.

Also you can’t fill your miner with water to get it to boiling, but these problems will all be solved in the future, like the company Block is building an open Bitcoin mining chip which will allow companies to buy just the chip and build miners in any shapes and use cases. This could allow a water heating company to produce a water heater where the electric coils are replaced by ASIC chips. Such a water heater would use the exact same energy as a normal water heater, but also produce Bitcoin along the way.

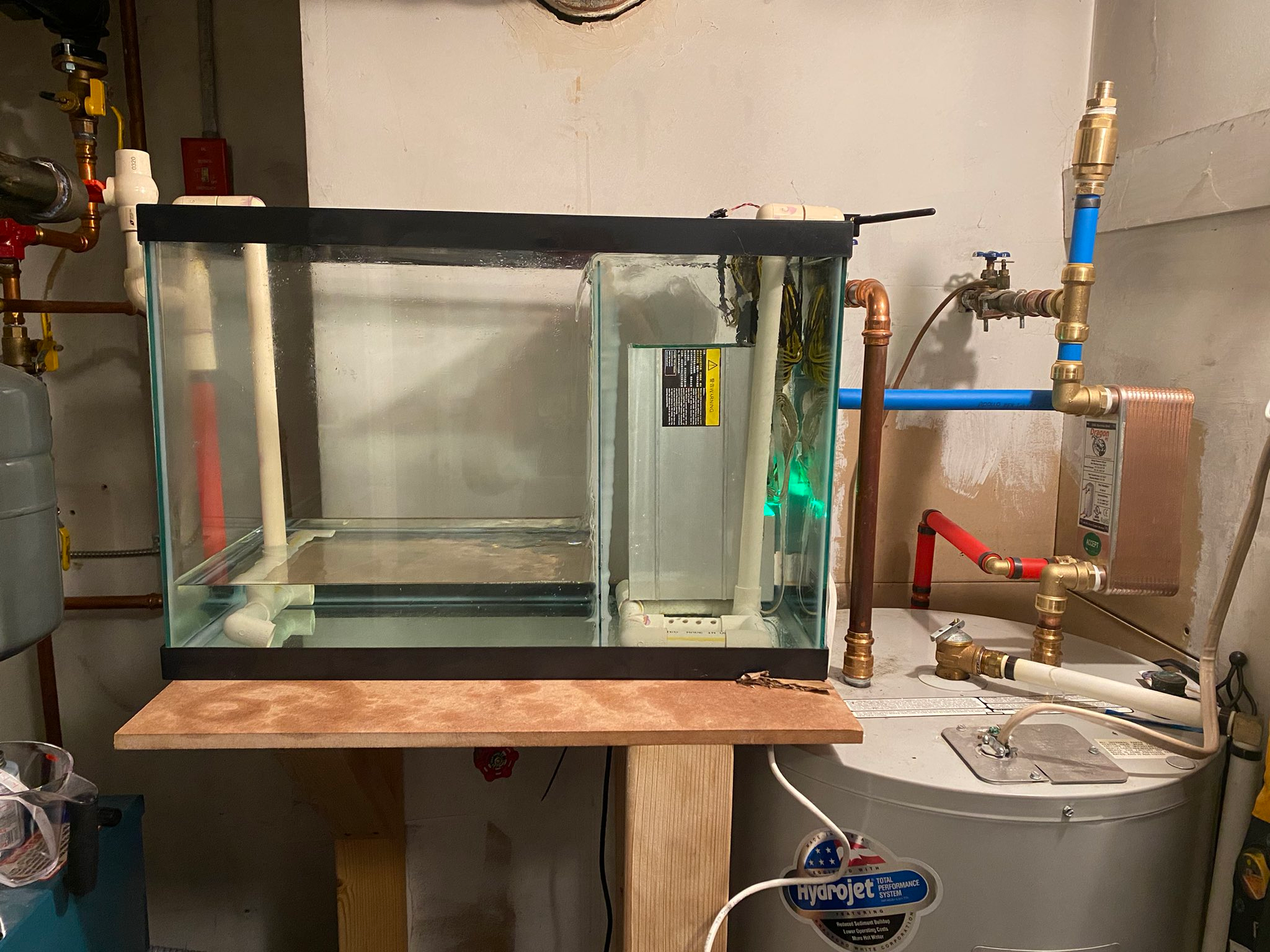

Today such a water heater does not exist yet, so I’m working on a slightly more complex system with immersion cooled miners that heat a regular water heater. Such a system is definitely not something for every home, but it allows to prove the point of the equal amount of energy use. I will publish data as soon as I have them. Others have made attempts to incorporate miners into their home heating systems with immersion technology, for example @StateFall, @WiseMining and @techengineer21 however, commercially available off-the-shelf solutions remain a unicorn.

Home mining take two:

excessive solar energy usage

Anybody that ever planned a solar panel system for their home knows the struggle of sizing: If it’s too small you will still buy a lot of energy from the grid. If it’s too big you end up with excessive energy that you will have to inject to the grid for a bad deal (some places pay less than the regular kWh price, some give you credits that you maybe never use and in some places you won’t even get anything at all). It’s logical that the grid operators don’t really want your electricity, as a home solar system owner generates too much energy when the sun is shining, the solar panels of the grid itself also generates more energy, so buying energy from home owners doesn’t make sense for the grid operators.

A home mining setup connected to the solar panels could solve this problem: Technically a bitcoin miner can ramp up and down their energy usage within seconds and even can use partial amounts of its total energy usage. Therefore the miner could monitor how much energy is produced by the solar panels, if there is too much energy produced, instead of giving it back to the grid, the miner could convert the excess energy into valuable Bitcoin which will be worth more than what the grid would pay for the energy.

I’ve been playing with setting up such a system, the problem is that all miners from Antminer and Whatsminer are built to use a constant amount of energy. While Antminers with Braiins software can scale down their energy usage up and down, the process itself takes a couple of seconds and involves a short restart of the miner which stops the miner from using power for a short time, not something you want if there is excessive energy existing. Over time the mining software will become better, or some hardware manufacturer will build a miner that can scale up and down fully uninterrupted. The miner could even include the required power measuring hardware so that it could just easily be connected to any solar panel system. There are companies like TrulySolar.com already existing that lease your roof and install solar panels with a Bitcoin miner, currently this is a completely separate system from your normal electrical home usage, but we definitely see innovation.

TL;DR: Bitcoin Home Miners: Start your ASICs!

While Bitcoin is becoming more and more adopted by governments and most probably is here to stay for good, this doesn’t mean that governments will start to use the Bitcoin miners to enforce their agendas, starting the Bitcoin Transaction War:

- Precedence has already been set for censoring transactions.

- Incentives exist for miners to become as large as possible.

- The larger the miner, the easier of a target they become for regulations.

- Incentives exist for large miners to comply with these regulations as a way to create regulatory moats around their businesses.

- Decentralizing hashrate is difficult but it starts with good protocol solutions like Stratum v2 and getting as much hashrate into the hands of the many as possible.

- There is no shortage of creative ways to incorporate a miner into one's home.

- Upcoming availability of individual miner chips will open up possibilities to include miners in any type of devices.

The future is bright, let’s keep it that way, one home miner at a time.

Additional resources:

To learn more about the risks posed to the censorship resistant tenants of Bitcoin through large scale miners, check out these other resources:

- Article of Bob Burnett: https://bitcoinmagazine.com/business/mining-industry-makes-bitcoin-vulnerable

- Podcast by Aaron van Wirdum and Sjors Provoost talking about Mara Pool and Mining Censorship: https://www.youtube.com/watch?v=B6EKs7WSXcI

- Podcast by Will Foxley and Steve Barbour talking about The Folly of the Mega-Mines: https://podtail.com/podcast/hashr8-podcast/the-folly-of-the-mega-mines-steve-barbour-compass-/

Thanks

Thanks to @BikesandBitcoin, @jyn_urso, @techengineer21, @econoalchemist for helping writing this article.